Direct Capitalization |

|

|

|

Direct capitalization is a process of converting a single year's income stream or cash flow into a value estimate through use of an overall capitalization rate. The assumption is that the forecast single year's net operating income is a stabilized forecast. Furthermore, the assumption is that the income stream will continue forever (a perpetuity) into the future. Direct capitalization is usually determined from the following formula:

Value = Income ÷ Rate

Where value is market value, income is NOI, and rate is the capitalization rate.

The overall capitalization rate is the capitalization rate for the land and the improvements combined. In advanced capitalization applications, it may be necessary to estimate a capitalization rate for the land separate and different than the capitalization rate for the buildings. Generally, the overall capitalization rate is referred to as simply "the capitalization rate".

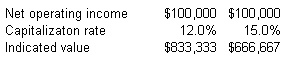

It is necessary to understand the effect the capitalization rate has on value of property.

If the capitalization rate of comparable sales goes up, the indicated value of the subject property will go down. The capitalization rate and the indicated value move in opposite directions.

The table below demonstrates this relationship:

Page url: http://www.georgiaappraiser.com/glossary/index.html?directcapitalization.htm