Sinking Fund Method of Estimating Reserves |

|

|

|

The Straight-Line Method of estimating reserves for replacements assumes that the owner will set aside funds in a non-interest-bearing account. If you want to have $1,000 to spend in five years, you must save $200 per year in an account that bears no interest.

Another method of estimating Reserves for Replacements is to use the sinking fund factor which assumes that the reserves will be placed in an interest-bearing account.

The sinking fund factor is defined as that amount which must be deposited periodically in order to grow to $1 with accumulated interest in a given period of time at a given rate.

Example: An appraiser estimates that the roof has a useful life 15 years. The estimated replacement cost is $15,000. The money can be saved in an investment that yields 8% compounded annually. How much must be saved each year to replace the roof.

Use the 8% compound interest rate table and select the number in the "Sinking Fund Factor" column that corresponds with 15 years. The factor corresponding to 8% for 15 years is 0.36830

Sinking fund amount = 0.036830 x $15,000 = $552.45 rounded to $552.

The owner must save $552 per year for 15 years at 8% interest to have enough to replace the roof.

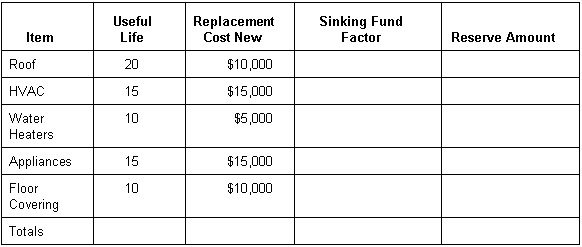

Exercise: You are appraising an apartment complex. You have observed the following short-lived items and have estimated their useful life. What should the reserve account reflect in the reconstructed operating statement using the sinking fund method of estimating reserves assuming an investment rate of 8%?

Use the table below to calculate your answers.

Page url: http://www.georgiaappraiser.com/glossary/index.html?sinkingfundmethodofestimatingr.htm